International Orders & Shipment Policies

Our textiles are woven and finished in rural artisan clusters in Bengal, then move to nearby metro hubs before leaving India. That extra leg is part of working with decentralized handloom production, and it can add a bit of time compared with brands shipping out of big city warehouses. The sections below explain how duties, carriers, and timelines work for international orders.

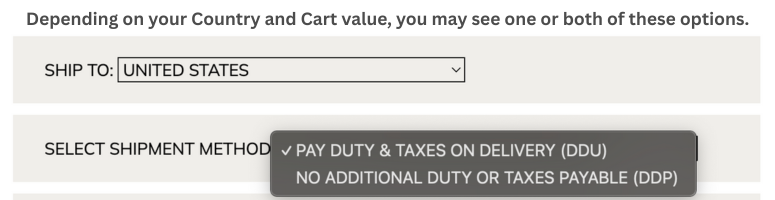

Duty Options at Checkout

No Additional Duty or Taxes Payable

(DDP style option – available for most of USA, and Canada)

- Estimated import duties and taxes are collected upfront at checkout.

- In normal cases, the courier should not ask you to pay extra duty or tax when the parcel arrives.

- This is useful if you prefer predictable landed costs and do not want to handle customs payments yourself.

- You may still be liable for local VAT or sales tax in some jurisdictions if required by local rules, but where our logistics partners support full DDP, that tax is generally part of the upfront estimate.

- Our logistics partners limit each shipment to a maximum of 20 kg. Larger or heavier orders will be split into multiple shipments and invoices as required.

Typical delivery time

About 9–15 working days from dispatch, depending on your country and customs processing speed.

“Customs authorities always have the right to reassess a shipment. In rare cases they may apply additional charges even under this option.”

Duty and Taxes Payable on Delivery

(DDU style option – available for all countries we ship to)

- Product prices and shipping fees at checkout are exclusive of import duties, VAT, and local taxes.

- When the shipment reaches your country, customs and the courier calculate any applicable charges and collect them directly from you.

- This option is often more economical for smaller or lower-value orders, but you must be comfortable paying duties and taxes separately on arrival.

Typical delivery time

About 7–12 working days from dispatch for most destinations, again depending on routing and local customs.

The exact shipping fee for each option depends on your destination and total cart weight and will be shown clearly at checkout once you finalize your cart.

Shipping Providers and Routing

All international orders move through express courier networks. We work with:

- DHL

- UPS

- FedEx

- Trusted logistics aggregators and regional partners

For every order, we:

- Select the carrier that offers the best combination of reliability, coverage, and cost for your country and weight band at that time.

- Use priority or express services wherever possible so that artisan-led production is the only slow part of the journey, not the shipping.

You usually cannot choose a specific courier at checkout, because routing can change based on service disruptions, fuel surcharges, or lane performance. For some B2B or wholesale orders we may be able to use your own FedEx or DHL account if agreed in advance.

Your Responsibilities

Regardless of the shipping mode or trade agreement used, you remain the importer of record in your country. That comes with a few non negotiables:

- Respond promptly to customs or the carrier if additional information is requested (for example tax ID, EORI, EIN, KYC documents, or product clarifications).

- Pay any duties, taxes, and clearance fees required to release the shipment, especially when you choose the Duty and Taxes Payable on Delivery option or when customs reassesses a DDP shipment.

- Provide accurate consignee details and documents to avoid delays or misrouting.

Delays in response or payment can cause storage fees, return to sender, or cancellation under carrier and customs rules.

“We do not manage customs clearance on your behalf, and we do not issue refunds for charges or issues arising from the buyer’s failure to handle customs properly.”

By placing an international order, you acknowledge that customs import duties and taxes may be due, that you are responsible for providing information and paying these charges where applicable, and that any duty or tax estimate shown on our website or by third-party tools is not a final quote from customs.

Would there be any additional sales tax and import duties?

- If you select No Additional Duty or Taxes Payable, duties and taxes are generally estimated and collected at checkout. In most cases, you should not be charged again at delivery, except in rare reassessment cases by customs.

- If you select Duty and Taxes Payable on Delivery, you may be subject to sales tax and import duties upon arrival of your goods depending on the shipping destination. In that case, prices at checkout are exclusive of VAT or sales tax and import duties, and it will be the shipment courier’s responsibility to collect VAT or sales tax and import duties upon arrival. You will be contacted by the courier service to arrange payments with them.

You may use third-party duty calculators as a handy tool to estimate charges. Remember to convert your total order value to your local currency. Any estimate is indicative only and not a final quote from customs.

If any shipment is unattended?

It is your responsibility to immediately respond to calls and emails from the courier service. If the shipment is unattended by the receiver, delivery attempts fail, or the parcel cannot be delivered due to incomplete information, the parcel may be returned and you will have to pay for delivery once again if you choose to have it reshipped. We will also notify you through message or email about such shipments.

What is the shipment unit size for large fabric orders?

For more than one unit of fabric, you will receive the running length of the fabric and not pieces. Due to the limitations of hand weaving and hand washing, one fabric roll or piece generally consists of up to 11 meters or 18 meters per unit.

Still have queries?

If you still have any query about anything, kindly drop us an email at “support@anuprerna.com” or connect through the contact us page. We will revert to you within 24 hours from Monday to Saturday, except on Indian public holidays.

related questions

How are fabrics counted for shipping?

arrow_drop_downEach product and each meter of fabric contributes to the total weight of your order. Shipping is calculated on the combined weight and destination, not on a flat rate per product. This is why adding one extra item does not always change the shipping cost, while crossing a weight slab can.

Why does shipping sometimes look similar for 1 item and 3 items?

arrow_drop_downCouriers use weight slabs, especially for international parcels. The first slab (for example, up to 0.5 or 1 kg) is the most expensive. One lightweight item and three lightweight items can fall in the same slab, so the shipping fee may not change much until you cross the next weight bracket.

Can I choose a specific courier like DHL or FedEx?

arrow_drop_downIn general, no. We select the carrier and service that offers the best balance of reliability, transit time, and cost for your route on that day. For some B2B or bulk orders, we may be able to use your own FedEx or DHL account if you share valid details in advance.

What happens if customs asks me for extra information?

arrow_drop_downFor international orders you are the importer of record. If customs or the courier requests a tax ID, EORI, EIN, KYC document, or any additional information, please respond quickly. Delays in responding or paying duties can lead to storage fees, return to sender, or cancellation under carrier and customs rules. We cannot refund orders that are refused or abandoned at customs.

Can two separate orders be shipped together?

arrow_drop_downIf two orders are placed with the same name and address and are still unshipped, you can email us at support@anuprerna.com and we will try to club them into one parcel. If either order has already been packed or handed over to the courier, we will not be able to merge them.

How do the India–Australia trade rules affect duty on my order?

arrow_drop_downIndia and Australia have a trade agreement that reduces or removes customs duty on many Indian exports, including a large share of textile and apparel products. If your order meets the rules of origin and is correctly documented, your shipment may be eligible for reduced or zero Australian customs duty. This is handled through our logistics partners and their brokers. Australian GST and local clearance or handling fees may still apply, and the final decision on any duty benefit always rests with Australian customs.

How do the India–UK trade rules affect duty on my order?

arrow_drop_downIndia and the UK have agreed a trade deal intended to bring most Indian exports into the UK at zero or significantly reduced customs duty over time, with textiles and clothing as a key focus. Where our products meet the rules of origin and documentation requirements, your shipment may qualify for reduced or zero UK customs duty. You may still be charged UK VAT and any courier clearance fees. As with Australia, the final assessment is made by UK customs, so duty free entry cannot be guaranteed on every parcel.

More Blogs

production policy

terms & conditions

privacy policy

return & exchange policy